Taxes

Taxes

Taxes

Who must file tax forms for 2025 tax season?

Even if you did not earn any income, if you were physically in the US on F or J status anytime between 1 January – 31 December 2025, you're obligated to file a Form 8843 with the IRS (the Internal Revenue Service, or ‘IRS’, are the US tax authorities).

Meanwhile, if you earned any taxable US source income, you may need to file a federal tax return with the IRS. Depending on your individual circumstances, you may also need to file a state tax return(s).

DISCLAIMER: International Student & Scholar Services (ISSS) and Rowan University are NOT permitted to assist any student/scholar with any IRS tax form preparation or tax-related questions. The information provided is intended for your benefit. Any questions or concerns should be directed to Sprintax, a certified tax preparer or a local IRS field office.

Tax Filing Deadline

April 15th, 2026 is the last day for residents and nonresidents who earned US income to file Federal tax returns for the 2025 tax year. The filing period for 2026 will open in January 2027.

Who is considered Resident or Nonresident for Federal Tax Purposes?

Generally, most international students & scholars who are on F, J, M, or Q visas are considered nonresidents for tax purposes. International students on J-1 & F-1 visas are automatically considered nonresident for their first five calendar years in the US, whilst Scholars/Researchers on J visas are automatically considered nonresidents for two out of the last six calendar years in the US.

If you’ve been in the US for longer than the five or two-year periods, the Substantial Presence Test will determine your tax residency.

How to File

We have teamed up with Sprintax to provide you with an easy-to-use tax preparation software designed for nonresident students and scholars in the US. We (and all other university staff) are not qualified or allowed to provide individual tax advice.

After you login to Sprintax, you will be asked a series of questions about the time you have spent in the US over recent years. Sprintax will then determine your tax status. If it determines that you are a "nonresident alien" (NRA) for federal tax purposes, you can continue to use the software to respond to a series of guided questions. Sprintax will then complete and generate the tax forms you need to send to the tax authorities.

However, if Sprintax determines that you are a resident alien for federal tax purposes, you won't be able to continue using the software.

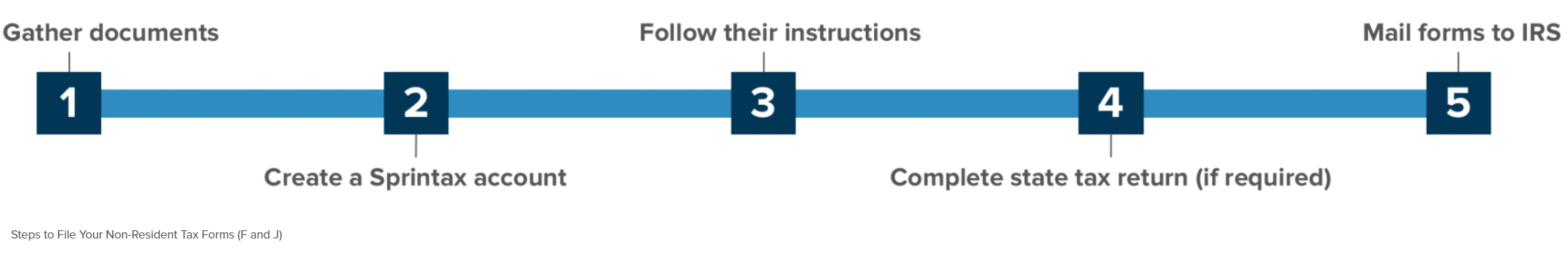

Step by Step guide on How to File Your Non-Resident Tax Forms (F and J)

1) Gather the documents you may need for Sprintax

✔ Passport

✔ Visa/Immigration information, including form I-20 (F status) or form DS-2019 (J status)

✔ Social Security or Individual Taxpayer Identification Number (if you have one): This is not needed if you had no income and the 8843 is the only form you have to file.

✔* W-2: This form reports your wage earnings if you worked. If you had more than one employer you should get a W-2 from each employer. It is issued by the end of January for the previous year. Make sure all employers from last year have an up-to-date address for you.

✔ 1042-S: This form is used to report:

- stipend, scholarship, fellowship income, and travel grants (not tuition reduction or exemption)

- income covered by a tax treaty

- payment for other types of services (e.g. by the semester as a note-taker)

If you received this type of income, the 1042-S will be mailed to you by March 15th by the payer.

Note: Only Non-Resident Aliens receive this form. If your tax status changes to a Resident Alien you will not get a 1042-S. Login to Sprintax to check your tax status if you're not sure.

✔ U.S. entry and exit dates for current and past visits to the U.S.: In addition to passport stamps, you can review or print your U.S. travel history here

✔ 1099: This form reports miscellaneous income. Can be interest on bank accounts, stocks, bonds, dividends, and/or earnings through freelance employment

✘ 1098-T: This form is NOT needed and can NOT be used for a nonresident tax return because NRAs are not eligible to claim education expense tax credits.

2) Create a Sprintax Account:

You will receive an email from the international student office providing you with a link to Sprintax to set up your account as well as your unique code to use on Sprintax. This unique code will cover the costs of the federal tax return and 8843 at no cost to you. Open your new Sprintax account by creating a UserID and password or if you have an existing account on Sprintax you can login using your existing credentials.

3) Follow the Sprintax instructions

Upcoming Sprintax Webinars:

Feb 18th @ 3pm ET – Register here

Feb 24th @ 10am ET – Register here

Mar 5th @ 12pm ET – Register here

Mar 11th @ 1pm ET – Register here

Mar 16th @ 2pm ET – Register here

Mar 27th @ 11am ET – Register here

Apr 1st @ 1pm ET – Register here

Apr 7th @ 8am ET – Register here

Apr 14th @ 2pm ET – Register here

If you did not earn any US Income: Sprintax will generate a completed Form 8843 for you and each of your dependents (if you have any).

If you did earn US Income: Sprintax will generate your "tax return documents", including either a 1040NR-EZ or a longer form 1040NR, depending on your circumstances.

4) (With U.S. income only) If required, complete your state tax return

After you finish your federal return, Sprintax will inform you if you need to complete a state tax return. If so, you will have the option to use Sprintax for an additional fee. However, it is your choice to use them or to do the state tax return on your own.

5) Read the instructions for filing/mailing your returns

Remember to read the instructions that Sprintax provides.

You will be required to download, print, and sign your federal tax return and mail it to the IRS. Depending on your circumstances, you may be able to E-file your Federal tax return. However, this will depend on certain eligibility criteria. You can learn more about eligibility in this Sprintax blog - https://blog.sprintax.com/nonresident-federal-tax-efiling-live/

If you have a state filing requirement, you must also mail this to the tax authorities.

Finally, if you only need to file Form 8843, this will also need to be mailed to the IRS.

Need Sprintax Support?

If you need help while using Sprintax, you can contact their support team using the options below:

Email - hello@sprintax.com24/7 Live Chat Help

Refer to their FAQs

Sprintax Educational Tax Videos and Blog:

You also have access to the Sprintax YouTube account where there are a number of educational videos on nonresident taxes. These will provide further clarity on nonresident tax and how to use Sprintax. Sprintax also offers a range of useful content on their blog to help you file your return.

DISCLAIMER: International Student & Scholar Services (ISSS) and the school are NOT permitted to assist any student/scholar with any IRS tax form preparation or tax-related questions. The information provided is intended for your benefit. Any questions or concerns should be directed to Sprintax, a certified tax preparer or a local IRS field office.